Each year, thousands of young people leave college with significant student debt. Most of those who choose the right majors, graduate on time, and find solid employment pay off their loans with little difficulty.

But students who never graduate, who choose the wrong majors, who take extra time to get a degree, or who can’t find lucrative, full-time employment often struggle with debt. A report conducted last year by Student Debt Crisis shows just how much student debt can burden young people. The report surveyed 7,095 adults with student debt from all 50 states in October 2018.

The survey found that many borrowers face financial hardship. In total, 65 percent of student loan borrowers reported having less than $1,000 in their bank account.

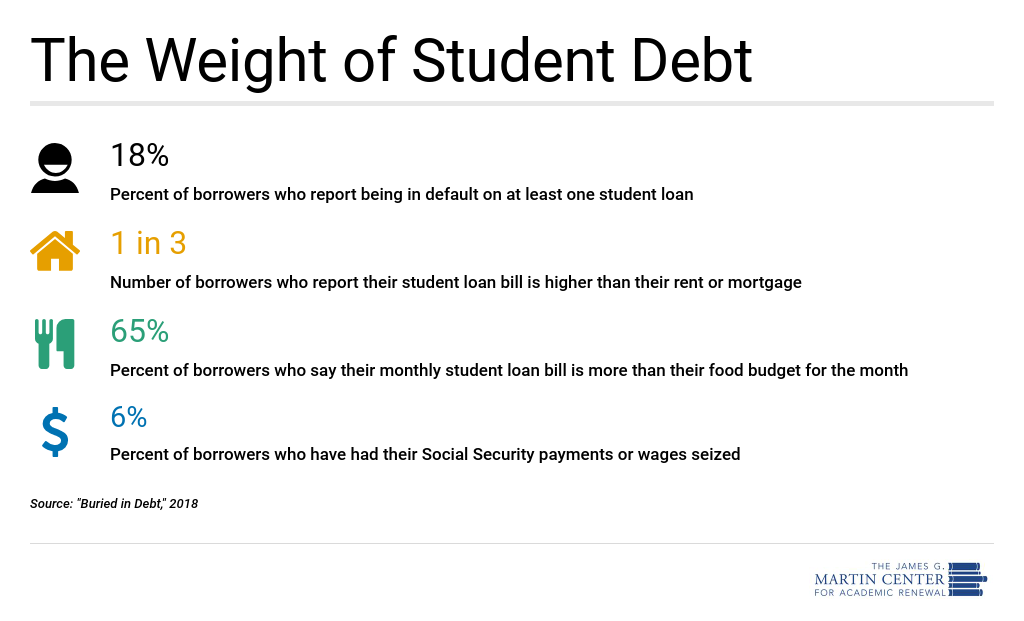

Borrowers spend a significant amount of their monthly budgets on student loan payments. Of all respondents, 30 percent reported having a student loan bill higher than their rent or mortgage bill. Another 56 percent said their student loan bill was higher than their health insurance bill. And 65 percent of borrowers reported having a student loan bill higher than their monthly food budget.

Many students struggled to make their loan payments. Eighteen percent reported being in default on at least one student loan. And 20 percent reported being unable to make their next loan payment.

Survey respondents also reported that student loan debt has prevented them from meeting certain financial goals. Eighty percent of respondents said student debt prevented them from saving adequately for retirement. Fifty-nine percent said it prevented them from making large purchases. Fifty-six percent reported that debt prevented them from buying a home. And 42 percent reported that debt prevented them from buying a car.

The full report is available here.

Jenna A. Robinson is president of the James G. Martin Center for Academic Renewal.