Mink Mingle, Unsplash

Mink Mingle, Unsplash [Editor’s note: The following article is adapted from “Treating Higher Education as an Investment,” published in the San Diego Law Review, 61.1, 2024.]

Colleges do not look like for-profit firms selling investments. After all, colleges are primarily nonprofits or state agencies, which, for our purposes, are treated equally. Nevertheless, colleges behave like for-profit entities where pricing and customer enticement are concerned. Too many students invest in college degrees of low or even negative value. Thus, colleges should be subject to regulations to protect those who purchase their services.

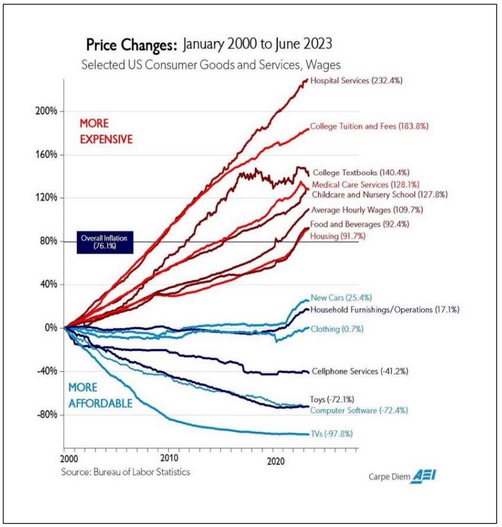

Had the cost of food, housing, clothing, or cell phones risen as much as the cost of college, there would be investigations. The competition for resources within colleges is intense. College employees compete to make their lives better with nicer offices, more trips, dining clubs, more colleagues to their liking, higher salaries, lower teaching loads, and other emoluments. Employee compensation is affected by private-sector alternatives. As former managers in colleges, we observed that administrators are liked by the faculty much more if they bring in added resources, and raising tuition is a means to that end. Conversely, the tuition amount is rarely cut to help students. Tuition continues to rise as those on the payroll of schools plead for even more resources under cover of their nonprofit legal status. Had the cost of food, housing, clothing, or cell phones risen as much in recent years as the cost of college, there would likely be investigations as to why this had occurred.

Colleges act like competitive firms in other markets in many respects. They compete for customers and specialize in niches in the market. For example, elite schools do not sell their wares to the masses. A large part of their appeal is their recruiting of elite students—employers know students of elite schools are well above average, so being at a top school helps ensure employment outcomes are better than those enjoyed by graduates of lower-ranked schools. It would not benefit an elite school such as Princeton to sell slots to anyone at high prices—this would raise revenue today but destroy the unique niche the school has due to its quality and selectivity. But other schools admit nearly every applicant who can get tuition covered by a loan if personal funds are not available.

Significant efforts costing at least $10 billion per year are put into attracting customers by colleges. While most schools try to give a perception of being at least somewhat selective, many colleges are not and have high admission rates. Whatever their niche, schools compete for students and use many strategies in a competitive market. A survey of admissions personnel at 215 colleges ranked the order of importance of recruiting strategies: emails, hosted campus visits, websites, high-school visits, parents, high-school counselors, direct mail, social media, college fairs, text messaging, online advertising, community-based organizations, test-optional policies, conditional or provisional admission programs, and alumni. Significant efforts costing at least $10 billion per year are put into attracting customers by colleges. This is similar to the behavior of for-profit firms in competitive markets, not the behavior of state agencies providing a service, such as renewing a driver’s license, or private charities dealing with clients who seek help.

Colleges compete on many margins to attract more paying customers. While colleges feature degree programs as part of the attraction, they may also focus on costly non-academic amenities. College football is maligned by critics, but there is evidence that it helps recruit students and may have a positive impact on school revenue.

Colleges, especially private schools, engage in complex price discrimination. That is, different customers pay different prices for the same college services. One empirical study found “substantial … market power and, importantly, sizeable variation in this power along the college quality hierarchy and among students with different characteristics.” First-degree price discrimination, in which a seller sells to each customer at a separate price, is highly desirable from the seller’s standpoint but is uncommon in most sales. “Yet, first-degree price discrimination is common in the pricing of higher education,” allowing revenue to be higher than would exist with uniform pricing. Colleges do not just behave like for-profit firms in the marketplace, they exhibit practices that many for-profit firms envy.

Daniel Golden earned a Pulitzer Prize for articles in the Wall Street Journal in 2004 by showing how preferences in admission were given to the children of alumni and donors. He expanded the articles into a book documenting many cases of this practice at elite schools. The book is filled with stories of underqualified children of the rich and famous getting into elite schools. Of particular interest here are the prices revealed.

How much does it cost to buy your child’s way into college? Educational consultants say a five-figure donation—as low as $20,000—is enough to draw the attention of a liberal arts college with an endowment in the hundreds of millions. At an exclusive college, it can take at least $50,000 with some assurance that future donations will be even greater. At top-25 universities, a minimum of $100,000 is required; for the top 10, at least $250,000 and often seven figures.

Given that these data are 20 years old, these numbers are likely much larger today.

Colleges are strategic in their behavior of selling services. This is further evidence of successful price discrimination. While the tuition listed at a school may be $60,000 per year, the price paid by wealthy parents, in the form of tax-deductible “donations,” raises the price paid substantially above the listed price. As author Jeffrey Selingo notes, the Varsity Blues scandal is an example of something that has gone on, legally, for years. Payments above posted tuition prices are used to ensure that the children of high-income parents get into elite schools.

Colleges are strategic in their behavior of selling services. Regardless of colleges’ legal status, they behave like competitive enterprises, not passive state agencies or charities passing out benefits to selected beneficiaries. To increase the appearance of selectivity, schools encourage students to apply even if there is little chance of admission. A former dean of admissions at Tulane said, “Colleges are a business … and admissions is its chief revenue source.” Schools track prospective students in a way that is similar to the “algorithms that Amazon … or virtually any other online retailer uses to offer you other things you might like based on your past selections.” There is nothing surprising about these sales practices when they are employed by for-profit firms. Their use is yet another way in which colleges behave like for-profit sellers.

The economic and financial literature on the theory of the firm does not focus on the nonprofit or for-profit status of an entity. The authors of pioneering work on the economic structure of firms were aware of the distinction, but it plays little role in the economic function of an organization except to express constraints imposed on certain entities.

Nonprofit firms coexist with traditional for-profit firms in other industries. The largest industry example comes from healthcare, which is provided by public, for-profit, and nonprofit hospitals. Hospital services have risen rapidly in price in recent decades, like prices in higher education. Hospital customers rarely think about the hospital’s legal structure, which is irrelevant in most cases since nonprofit hospitals act much like for-profit hospitals: “nonprofit hospitals are starting to look like for-profit entities: Revenues in the billions, executive salaries in the millions.” Like nonprofit colleges, nonprofit hospitals are exempt from taxes, can issue tax-free bonds, and receive government subsidies. In return for these privileges, both hospitals and colleges are expected to provide public benefits. A leading scholar in this area, Professor David Hyman, summarizes much of his earlier work, and that of others, to show that there is little difference in the provision of “charity” care by nonprofit and for-profit hospitals, despite nonprofits having a legal obligation to provide such care.

Colleges benefit from the lack of legal accountability that should apply to the sellers of such costly services. Just as nonprofit hospitals get preferential treatment, colleges also benefit from the lack of legal accountability that should apply to the sellers of such costly services. We believe part of the reason large increases in tuition have occurred is the lack of information among college students, leading many to invest in degrees of negligible or negative value. Colleges lack the legal and market disciplines that apply to vendors of services and investment opportunities in most major markets. There is no reason colleges should not be subject to regulations to protect those who purchase their services.

Rather than focus on forgiving debts after they are acquired, we argue that existing laws can help protect inexperienced investors (students) from making dubious choices. This solution has several virtues. First, it relies on existing laws, minimizing the need for legislative action. For example, applying the Federal Trade Commission Act (FTC Act) to the purchase of higher-education services does not require Congress to pass a complicated new statute; only an administrative decision is needed to apply the FTC Act to certain aspects of the sale of education by colleges. Second, consumer-protection investment regulatory measures are often enforced by private lawsuits. Applying them to higher education should be no different. Federal and state consumer-protection agencies that enforce such statutes could gradually expand enforcement activities into higher education at a comparatively modest cost. Third, universities could easily be made to adopt standards requiring information about the average salaries earned by graduates in each degree program to be provided to prospective college students.

When providers misrepresent the costs or advantages of investing in higher education, our approach would make all purchasers of higher education eligible for relief, not just those who borrowed to pay for their purchases.

Roger Meiners is the Goolsby-Rosenthal Chair in Economics and Law at the University of Texas at Arlington. Andrew P. Morriss is a professor in the Bush School of Government and Public Service and the School of Law at Texas A&M University.