Logan Voss, Unsplash

Logan Voss, Unsplash For families across North Carolina, the most confusing part of the college decision is no longer writing application essays but trying to pin down a price that often feels deliberately elusive. Financial aid is layered, conditional, and often opaque, and college websites—packed with tuition tables, disclaimers, and optimistic “average net price” figures—can leave families with more questions than answers about what they will actually owe.

Enter college profiler Niche.com’s newly expanded “True Cost” college-costs estimator, which translates sticker prices into estimates of what families might really pay after financial aid. The new tool is user-friendly and intuitive, but running a hypothetical middle-class North Carolina student through the site and selecting schools such as UNC-Chapel Hill, NC State, Duke, and Wake Forest reveals complicated results.

The calculator is designed to address a growing problem for middle-class families. The calculator usefully shows how dramatically financial aid reshapes sticker prices, but it also points to a basic reality: College pricing has become so dependent on assumptions and projections that even the best tools can offer only educated guesses, leaving middle-class families navigating uncertainty rather than guarantees.

Families face rising college costs and are often forced to make decisions without a clear understanding of actual numbers. The tool is straightforward: Students enter basic information about themselves and their family—including household income, state residency, and academic profile—then select their preferred colleges. Next, a “True Cost,” taking into account prospective scholarships, grants, savings, and other aid, appears.

Specifically, Niche generates an estimated net cost that breaks down tuition, housing, and projected financial aid (such as scholarships and grants), allowing schools to be compared side by side. This permits families to compare each school in theory before official financial aid is offered. The estimates are not promises—actual costs will vary—but the tool offers a clearer sense of affordability, working best as a way to compare schools, not as a promise of what a family will ultimately pay. As previously suggested, the calculator is designed to address a growing problem for families, particularly those in the middle class, who face rising college costs and are often forced to make decisions without a clear understanding of actual numbers. While the estimates are not guarantees, the tool offers an early framework for comparison in a system where transparency remains elusive.

To test the tool, the Martin Center imagined a hypothetical middle-class North Carolina resident. We used standard inputs for household size, savings, and FAFSA eligibility, along with average academic credentials where required, including SAT or ACT scores. Our analysis focused on five N.C. universities: UNC-Chapel Hill, NC State, Duke University, Wake Forest University, and UNC Wilmington. Our test used assumptions meant to reflect a typical North Carolina family: a household income set to align with the median state income of $74,000 (compared with $81,600 nationally in 2024, according to USA Facts) and a tuition budget of $20,000 per year before financial aid. Our student’s academic profile approximately reflected the state averages: a 3.37 GPA, an 1176 SAT, and a 20 ACT. Our household was a married couple with two children, filing taxes jointly, with no non-retirement investments, no home ownership, and no student income. Our student, born in 2008, will be 18 in 2026, will live on campus, will likely work while in college, and will remain on the family health plan.

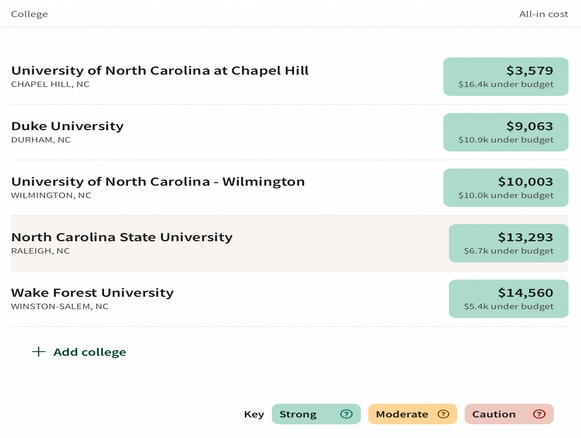

These inputs generated projected costs and aid packages for comparison across our selected schools. Taking into account our provided household income, family size, grades, savings, investments, and marital status, the results showed clear differences between in-state public universities and private schools. Specifically, the estimated costs at Duke and Wake Forest skyrocketed above those at UNC-Chapel Hill, NC State, and UNC Wilmington. Still, the calculator said that all five schools are within budget for an average middle-class North Carolinian.

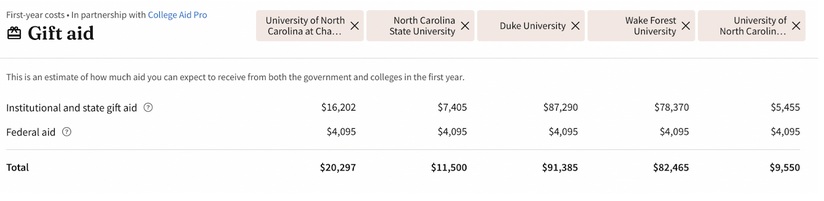

According to the report we received from Niche, the list price for the first year of tuition (in-state where applicable), fees, room, and board is $25,377 at UNC-Chapel Hill, $23,917 at NC State, $20,663 at UNC Wilmington, $96,265 at Wake Forest, and $99,214 at Duke University. The differences between the public and private schools are extreme. Yet the calculator predicts that all the schools we chose are within a middle-class budget, thanks to exceptionally high estimates of “gift aid,” comprising institutional scholarships and state and federal grants. The predicted “all-in cost” (or out-of-pocket price) for the first year is $3,579 at UNC-Chapel Hill, $13,293 at NC State, $10,003 at UNC Wilmington, $14,560 at Wake Forest, and $9,063 at Duke.

For many families, these figures would be misleading. State aid for private colleges is typically minimal, middle-income families often receive less need-based aid than do lower-income households, and work-study arrangements may not work for every student. The result is that financial tools such as the one offered by Niche can make prestigious private universities appear more affordable on paper than they truly are, masking the reality that middle-class families may still face substantial out-of-pocket expenses in an era of rising tuition costs.

Financial tools such as the one offered by Niche can make prestigious private universities appear more affordable than they truly are. Another key consideration is how academic and merit-based factors influence aid estimates. The Niche calculator assumes that middle-class students meet average academic profiles for the schools selected, but, in reality, even small differences in GPA, test scores, or extracurricular achievements can change the amount of merit-based scholarships a student receives. A student slightly above the average academic profile may qualify for additional merit aid at private institutions, while one slightly below may receive far less (or may not be admitted to his or her target schools at all). This creates uncertainty for middle-class families, who may plan their budgets around projected aid that ultimately does not materialize, showing that college affordability is not only a financial equation but also closely tied to student academic performance.

As Niche makes clear, the numbers below are mere projections:

Beyond tuition and aid, middle-class families must also consider their available resources and financial flexibility. While the median North Carolina household earns roughly $74,000, typical assets such as checking, savings, and non-retirement investments often have modest balances. This means that, even after accounting for expected financial aid, families may have limited cash on hand to cover initial expenses such as deposits, books, and personal costs. For many middle-class households, paying for college requires careful budgeting, potential borrowing, or working while in school, making the “affordable” numbers generated by tools like Niche’s a mere starting point. Conversely, if our prospective student’s parents owned a house and had $50,000 in a cash emergency fund, our chosen schools (and Uncle Sam) would presumably be less generous.

For middle-class North Carolina families, affordability increasingly depends on assumptions about aid that may never materialize. The contrast between North Carolina’s public universities and its private institutions becomes clearer when looking beyond aid estimates and focusing on how costs are structured. In-state public universities benefit from state subsidies that keep tuition and fees relatively stable and predictable, even as overall costs rise. Private colleges, by contrast, rely heavily on tuition revenue and institutional aid to manage affordability, resulting in much higher sticker prices paired with complex and variable aid packages. For middle-class families, this means public universities often present fewer financial surprises, while private schools can appear affordable only after layers of assumptions about aid are applied. The Niche calculator captures this tension by showing dramatically different starting prices that are lowered only through projected aid, underscoring how much more uncertain and individualized the financial equation becomes at private institutions.

Niche’s “True Cost” calculator is not without value. It reflects a genuine attempt to translate college sticker prices into something closer to what families might actually pay, and it offers a clearer comparison than many college websites provide. But the results of this analysis also expose a deeper problem in higher-education financing: Even well-designed financial tools can get families only part of the way there. For middle-class North Carolina families, affordability increasingly depends on assumptions about aid that may never materialize, loans that must eventually be repaid, and projections that vary widely from one student to the next. Public universities, with their lower and more predictable costs, continue to offer the most transparent path for families trying to plan responsibly.

Until colleges provide clearer, more standardized disclosures about what students will actually owe, tools like Niche’s calculator will remain helpful but imperfect guides—useful for comparison but no substitute for a system that offers middle-class families clarity rather than guesswork.

Reagan Allen is the North Carolina reporter at the James G. Martin Center for Academic Renewal.